Dear customers, partners, and friends of Enhancify,

In past weeks and days I've heard from many of you. As a community, there are some of us are taking a big hit right now.

Some of you have had to close up shop for now, let go of your team, and even wonder how you're going to put food on the table in coming months.

This squeeze on the economy is painful and will impact us all -- maybe the toughest part is not knowing how long it will last.

That said, we are not regular people -- we are business owners and entrepreneurs. We are a different breed.

When things are uncertain and others panic, we focus on what we can control and create new opportunities.

When life kicks us in the gut, hard...we don't stay down. We can't. In fact, it makes the fire inside flare up more.

We get up, because we will not lose. We will not quit. The harder life hits us, the harder we hit back.

We don't waste time feeling bad for ourselves or blaming others -- we get to work.

The reality is, things are likely to get worse before they get better.

But it's also true that the best companies are forged during recessions.

To that end, starting from today my team and I are going to begin sharing regular resources, knowledge, curated from trusted sources and partners to help you not just "survive", but grow and win during this time.

Remember, there will be companies directly in your space who will dig in, fight hard, and come out of this as the undisputed leaders. Why should that not be you?

Today, I want to share important information and instructions: how to get immediate financial relief for your business through the US Stimulus Package (CARES Act) and other sources.

Here's What You Need To Know:

- On March 27th, the US signed into law a $2T stimulus package to boost the economy and provide relief for businesses, called the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

- As part of that package, there are now multiple programs to help small businesses getting hit hardest to keep paying employees, serving customers, and moving forward.

- These programs are designed to provide grants and low-interest loans to business that need it.

- There are multiple programs and it can be confusing to find the right info. Here is what we've found to make things easier.

(Note: We are not affiliated with or endorsing any program or third-party entity. We're just trying to share helpful information. You should always do your own research, consult your accountant, and make decisions for yourself.)

1. The Paycheck Protection Program (PPP):

- This is a $349 billion program specifically designed to help keep American workers employed, by providing low-interest loans to help business cover the cost of their payroll.

- This is the largest program available, with businesses able to apply for up to $10M "determined by 8 weeks of prior average payroll plus an additional 25% of that amount."

- Here's the most important part: "If you maintain your workforce, SBA will forgive the portion of the loan proceeds that are used to cover the first 8 weeks of payroll and certain other expenses..." (SBA.gov website)

- "...loans will be fully forgiven when used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll...No collateral or personal guarantees are required. Neither the government nor lenders will charge small businesses any fees." (Treasury.gov website)

- Otherwise, the loan has a maturity date of 2 years and an interest rate of 0.5%. Loan payments are deferred for six months.

To learn more about the PPP, eligibility, and other details:

Q: How, when, and where do I apply?

- Here is the official application, released yesterday

- Small businesses and sole-proprietorships can apply beginning April 3rd, 2020.

- Independent contractors (1099) and self-employed individuals can apply beginning April 10th, 2020.

- Apply with the application through "any existing SBA lender, FDIC, federally insured credit union, and Farm Credit System institution that is participation." In other words, the money will be made available to local banks who will be happy to bank this. Consult your local banks, or the SBA.gov website for a list of SBA lenders.

- Payroll costs

- Salary, wages, commissions, or tips (capped at $100K for each employee on an annualized basis).

- Employee benefits

- State and local taxes assessed on compensation

- For a sole-proprietor or independent contractor: wages, commissions, income, or net earnings from self-employment, capped at $100K on an annualized basis.

- Interest on mortgage obligations

- Rent

- Utilities

- The Small Business Administration has earmarked $50 billion in disaster relief loans to businesses impacted by the COVID-19 pandemic.

- These are referred to as Economic Injury Disaster Loans (EIDL's)

- You can receive an EIDL as well as support from the PPP (Paycheck Protection Program).

- You can apply for an EIDL of up to $2M and use them to "fixed debts, payroll, accounts payable and other bills that can't be paid because of the disaster's impact." These are low-interest loans that do not qualify for forgiveness. Interest rates are set at 3.75% for small businesses and the SBA is offering repayment plans up to 30 years, depending on your businesses ability to repay.

- You can also apply for a $10,000 loan advance, that will not have to be repaid.

- According to the SBA website, "Funds will be made available within three days of a successful application."

- The PPP includes loan forgiveness on a portion of the loan, as long as you spend it primarily on payroll. Effectively, this turns into a grant you do not have to pay back.

- The EIDL comes with a "loan advance" of up to $10,000, which is a grant you do not have to pay back.

- You can apply for and potentially receive financial relief from both programs.

- The budget for PPP is several times larger than EIDL, so it may be smart to apply soon for an EIDL.

- Both programs have capped budgets and, as you can imagine, massive demand. If you're interested in applying, you should do so sooner rather than later.

- Do your own research, decide if any of these programs are right for your business, and apply.

- Remember, you can apply for multiple programs and it's probably better to do so sooner rather than later because demand will be high and the stimulus budget is limited.

- If this guide was helpful, great. My request is to please share it to a friend you think will find it useful too.

- My team will turn this into a blog post that we'll keep updated with the latest info.

- On that note, what do you need right now? What are you struggling with and what's missing for you?

- We'll be creating and sharing regular resources to help you come out of this better than when you came into this. Reply back, I read every email.

Q: What does it mean for the loan to be forgiven?

This means you may not need to pay back the loan. There are guidelines that must be followed, including a requirement to maintain payroll during the crisis. Please see the SBA website and the application for specific details. You will need to request loan forgiveness through your lender.

Q: What can I use these loans for? What counts as payroll costs?

2. SBA Economic Injury Disaster Loan (EIDL) and Loan Advance:

For full eligibility requirements and to apply for the SBA Economic Injury Disaster Loan program, go to https://covid19relief.sba.gov/

Q: PPP vs. EIDL - Which one is right for my business?

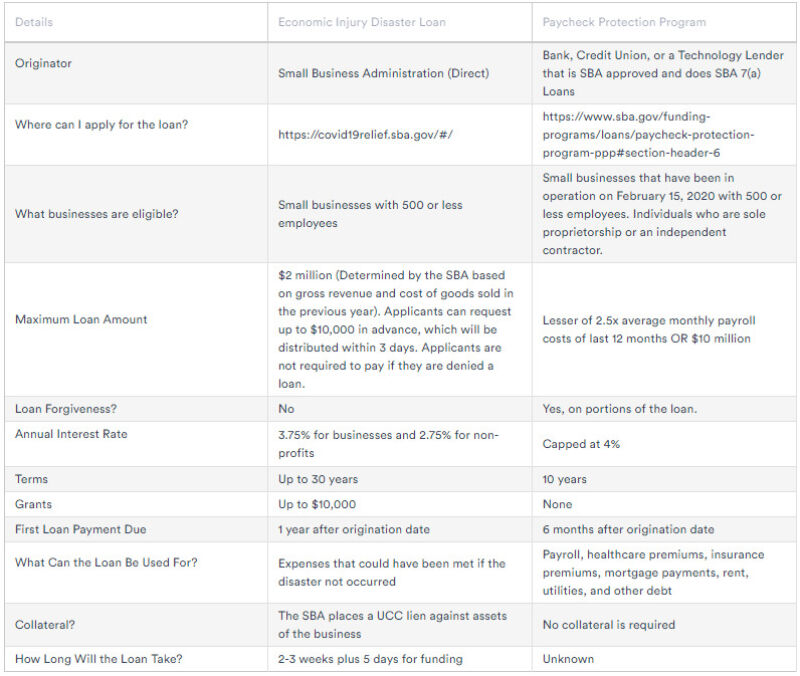

Below is a good summary --

(Thank you to the Zenefits team for putting this chart together.)

Key things to keep in mind:

3. State & Local Relief Programs:

In addition to the two federal programs above, many states and localities are offering support to small business as well.

While the federal government has the biggest war chest, it makes sense to look at your state, city, and county resources as well. Many are offering grants, low-interest loans, no-interest loans, and bridge loans.

The best part of the program is that the loans can be forgiven so long as employers keep their workers on the payroll and (mostly) keep their salaries intact.

Here is a solid list of financial assistance programs for small businesses, by state.

4. Bank Relief Programs:

Many banks are offering relief programs, low or no-interest loans, waivers, and other types of working capital.

You should call your bank to see what they can do for you.

Here is a list of relief initiatives by American banks (American Bankers Association).

Action Steps:

Finally, I want to say that while we are in uncertain times and difficult...we are all experiencing this together.

Now is the time for our industry to come together, get on the same side of the table, and set an example for the rest of our communities on what it means to persevere and win, on what an American small business actually looks like.

The reality is, one day we will look back on this and see the person we became during this adversity...the type of business owner...the type of partner and team mate...the type of family member. We get to choose what that looks like.

Let's focus on what we can control. There is a lot. And let's get to work.